While you have workers in your company, you must deduct taxes to make monthly mortgage payments. And irrespective of how you compensate your staff (via deposit, for example), there seems to be one thing you must always offer them: a pay stub. What exactly is a paystub? What can you find on such a paystub? Is that essential to give each of your staff ones?

Pay stubs are essential record-keeping documentation for both you and your coworkers. Pay stubs, on either hand, have diverse regulations, laws, and conventions from nation to nation – or even jurisdiction to jurisdiction. Whether you’re recruiting internationally, this can provide several professional issues. This article will explain pay stubs and address your frequent top questions about them.

Significance Of A Pay Stub

Each pay month, an individual’s payment is accompanied by a pay stub. These hardware or software records, often referred to as a “payslip,” “wage report,” or “pay packet stub,” provide vital information regarding an employee’s salary.

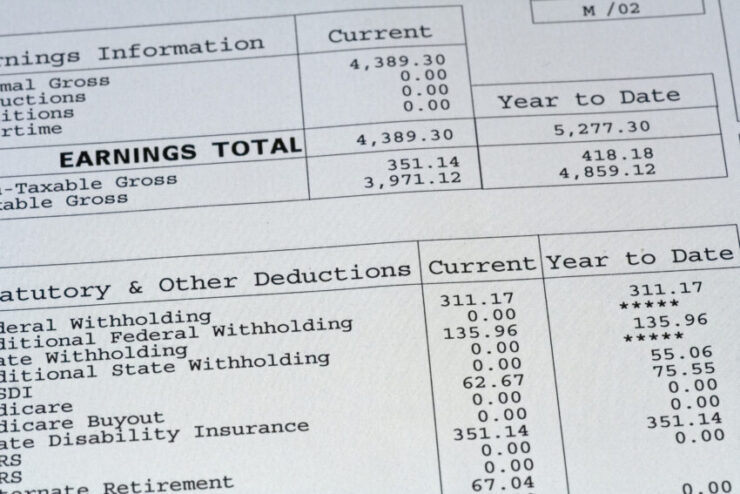

Workers’ earnings are categorized on paycheck stubs for a specific payment period, which could be biweekly, quarterly, or stipulated in the employment agreement. This also displays the taxable year’s gross compensation and expenditures.

Total hours, net earnings, deductibles, pension payments, and gross salary are all included on a pay stub. Some authorities utilize additional data.

What Sort Of Data Is Included In A Pay Stub?

Workers don’t receive the precise quantity mentioned on their gross salary. Taxation and other exclusions are considered when determining the overall take income or total compensation. The data calculating the worker’s wages is provided on such a pay stub.

This comprises bonuses and exclusions computed and applied to the gross salary sum. This pay stub must provide the worker with all relevant info determining the quantity that is now being compensated for the payment period, including a detailed breakdown of all adjustments performed and employer-paid fees and other sums.

How Would A Pay Stub Appear?

Pay stubs may vary greatly from nation to nation due to the fact that every government has its own set of standards for what details should be included. Most firms now use their payroll generator to electronically create and transmit pay stubs. Digital pay stubs, often known as “e-pay stubs,” are easy to keep and retrieve.

However, most firms are still using traditional paychecks, wherein, for instance, printed pay stubs are often perforated and affixed. For reference purposes, the management and the staff should save original pay stubs, including duplicates.

Is There A Difference Between A Pay Stub And A Paycheck?

The paycheck is a check that is provided to an individual as remuneration. To obtain the payment, the worker cashes the check. The majority of employers withdraw the paycheck straight into the employee’s bank, ensuring that the balance of the payment is sent to the employee’s consideration during the pay period.

The pay stub isn’t just about a check. It’s a piece of paper that comes with the paycheck. It might be provided to the employee or made accessible to them electronically. The pay stub contains all deductions applied to the individual’s annual pay and other employer-paid expenses.

How To Interpret A Pay Stub

Pay stubs may appear difficult at first sight, but once you know words like “gross salary,” “net salary,” and “tax deductions,” they make a lot easier to interpret. Now let’s examine it for you.

1. Taxation And Withholdings For Employees

Individuals must pay taxes and levies in several countries, including taxable income, pension contributions, and severance excise duties. Determining, deducting, and sending the necessary amounts of worker taxes to the regional tax agency is frequently the company’s responsibility. Companies may also deduct the amount like insurance rates or mortgages that the worker earns.

2. Wages (net)

“Gross salary” alludes to an individual’s total salary, excluding taxes and expenses.

To figure out a monthly employee’s gross salary, split their yearly salary by the length of billing cycles that year, then add some other payment they got during that time. Multiply this number by the average worker’s hourly wage level by the average hours worked during the billing cycle for an hourly employee.

3. Net Salary

Since the number of funds received within every check, an individual’s net salary is known as their “take-home income.”

Net salary is calculated by deducting all applicable payroll taxes from the employee’s pay compensation. The sum of cash an enterprise must transmit to a worker every payment cycle is known as net salary.

4. Employer Contributions And Taxation

Companies are frequently responsible because of their taxes and payments. These are not removed from an employee’s regular compensation, though. Rather, the funds are paid directly to the company’s local tax agency or applicable account.

What Is The Best Way To Make A Pay Stub?

Payroll stubs were previously calculated and analyzed in businesses. Pay stubs may be calculated and written physically in certain smaller firms. This is time-consuming and fallible. PaystubsCity, for instance, is a sophisticated computer-based system that rapidly analyzes payments and generates pay stubs. This simultaneously refreshes the payslips in the applicable accounting books.

The platform also helps develop e-pay stubs, meaning electronic pay stubs, which can be emailed or made accessible to employees electronically. These pay stubs are indeed kept in a database.

Is It Necessary To Provide Pay Stubs To The Staff?

It’s a challenging experience. Although some countries mandate businesses to send pay stubs to their workers, some do not. When you’re employing immigrant workers, you should be aware of the legal requirements within every state or nation where they’ll be working. Even if it’s not required by law, delivering pay stubs is a great practice, and so many workers will expect to be given it.

Conclusion

To conclude, a pay stub, often known as a pay packet, is a vital record for both you and the workers. It usually covers the main details:

Data about the individual and the organization, including names and addresses,

The hours worked during the payment period, and the amount of compensation are all factors to consider. Even if it’s not mandatory, it is an incredibly beneficial practice.