Loan agreements provide a vital framework for both individuals and businesses. They set out the terms of a financial arrangement in writing, helping to avoid confusion or disputes later on. From informal personal loans to formal business lending, having something in writing ensures all parties understand their responsibilities from the start.

These agreements typically outline how much is being borrowed, when it must be repaid, any applicable interest, and what happens if the borrower fails to repay on time. Without that clarity, even well-meaning arrangements can lead to misunderstandings.

Why Templates Are a Smarter Choice Than Starting from Scratch

Some borrowers and lenders still rely on verbal agreements or loosely written documents. While these may seem convenient at the time, they rarely hold up under scrutiny if issues arise. Using clear, structured legal templates ensures that every important detail is covered.

Professionally written document templates are designed to be comprehensive and easy to understand. They are especially useful for small businesses or individuals without access to legal teams, offering a straightforward way to create legally sound documents that match your specific needs.

For example, a lender might expect monthly repayments, while the borrower assumes a lump-sum deadline. Without clear terms, such misunderstandings can escalate quickly, potentially damaging personal or business relationships. Templates reduce this risk by prompting users to consider and document every important detail.

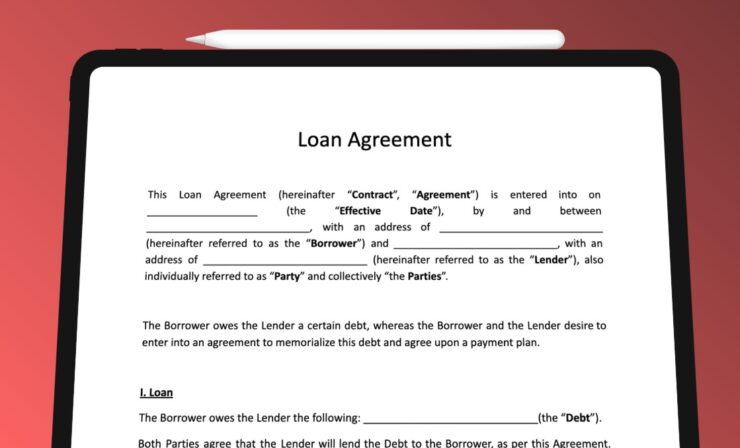

What to Include in a Strong Loan Agreement

A well-prepared loan agreement should cover the basics and go beyond them. It should name the parties involved, detail the amount borrowed, repayment dates, interest (if any), and any security being offered. It should also explain the consequences of late or missed payments and outline the rights of both lender and borrower.

Legal templates crafted for use in the UK will typically account for all of these elements. They also use terminology and structure that align with British legal expectations, making the document more reliable in formal or legal settings.

Where to Find Trusted UK Templates Online

With so many online options, it can be hard to know which templates are trustworthy. The safest option is to use a source that specialises in UK law and regularly updates its documents.

One such provider is Simply Docs, which offers a comprehensive selection of loan agreement templates UK. These templates are part of a wider collection of legal templates and document templates covering HR, health and safety, business management, and more. They’re written by professionals and designed to be practical, clear, and legally sound.

Why It Pays to Get the Paperwork Right

Putting a loan agreement in writing helps avoid misunderstandings and gives both parties peace of mind. Whether you’re helping out a friend or financing part of your business, using a reliable template can make the process easier and more secure.

Rather than risk using an outdated or incomplete form, it’s worth taking the time to find a legally sound template that fits your needs. It’s a simple step that could make a big difference later on.